News & Insights

News & Insights

BY Stephanie Wierwille

A marketer’s guide to successfully breaking into healthcare

Back in 2019, the BPD team had an ongoing joke in Slack when companies announced their entrance into healthcare: “This week in ‘every company is a healthcare company’…!”

From Amazon to Apple, Best Buy, Costco, CVS, Dollar General, Google, Kroger, JP Morgan, Microsoft, Uber, Walmart, YouTube — there’s at least one for every letter of the alphabet.

Fast-forward through the pandemic — when literally every company was forced to become a healthcare company — to today. Many of these organizations have successfully transitioned into true healthcare organizations. Others are having a harder time establishing trust in the space.

What separates the winners from the losers goes beyond their healthcare offerings. It’s the “healthy signals” they send to the market — the breadcrumbs they drop that cause consumers and providers alike to trust them with their health. These signals start long before that first announcement and must build through the brand’s maturity into healthcare.

Whether your brand’s heritage is retail, tech, finance, logistics, or other verticals, here are four marketing musts for shifting into healthcare.

1. Signal your entrance with an expanded brand position

You don’t need a shiny new brand positioning to signal your healthcare entrance into the market. Amazon, Apple, and Walmart all used their existing brand positions as a jumping off point:

Amazon’s reputation for convenience set up its partnership with One Medical beautifully — it’s a natural fit for concierge medicine.

Amazon’s reputation for convenience set up its partnership with One Medical beautifully — it’s a natural fit for concierge medicine.

Apple’s focus on privacy makes it trustworthy to capture and store consumer health data across the Watch, Apple Health app, and Apple Research

Apple’s focus on privacy makes it trustworthy to capture and store consumer health data across the Watch, Apple Health app, and Apple Research

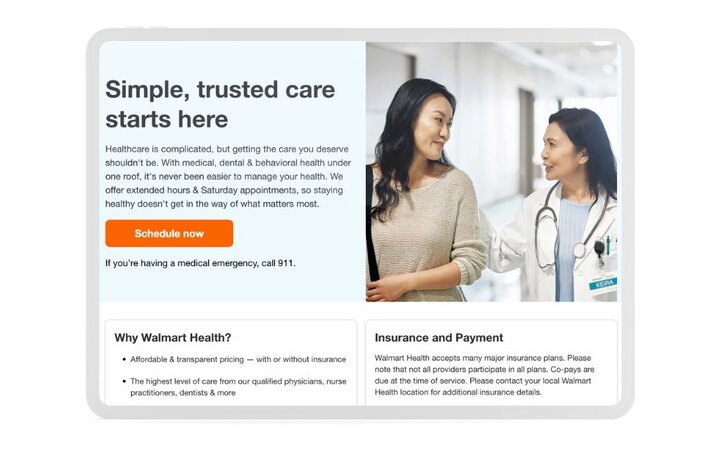

Walmart’s longstanding message of “everyday low prices” and real estate strategy set up Walmart Health for a value prop focused on affordability and access—including free testing and screenings and 75+ planned clinics by 2024.

Walmart’s longstanding message of “everyday low prices” and real estate strategy set up Walmart Health for a value prop focused on affordability and access—including free testing and screenings and 75+ planned clinics by 2024.

Microsoft believes in “empowering every person and every organization on the planet to achieve more.” So, what’s their healthcare moonshot? Building an AI-based infrastructure to help clinicians solve global challenges efficiently.

Microsoft believes in “empowering every person and every organization on the planet to achieve more.” So, what’s their healthcare moonshot? Building an AI-based infrastructure to help clinicians solve global challenges efficiently.

In each of these cases, there’s novel value for the market. Each of these fills a white space in the already crowded healthcare space. Yes, there’s massive revenue potential for a brand to expand into the health space. (After all, healthcare spending makes up 18.3% of the U.S.’ GDP in 2023.) But the revenue potential can’t be the only basis for the move… it must be rooted in a true unfulfilled consumer — or provider — need.

If your value prop is “high quality healthcare that leads to better patient outcomes” or “we exist to make Americans healthier” or any version of this… that’s not novel value.

So, let’s brainstorm some examples of companies forging this path today:

- Could Dollar General take a true stand for health equity, given its rural footprint and mobile clinics?

- Could YouTube leverage its mission to ‘give everyone a voice’ to further YouTube Health’s work to give doctors, clinicians, and healthcare organizations a megaphone for accurate healthcare information?

Start with what you’re known for today and consider — what about my overarching brand positioning would fill a gap in today’s healthcare landscape?

And no, the answer is not clinical quality, safety, expertise, or anything else that consumers consider table stakes.

Bonus points for having this figured out before you decide to make your big move into healthcare. But if not, we’re happy to help!

Got it solved? Now onto the next step.

2. Unlocking the customer data gold mine

There’s one critical asset that legacy healthcare organizations lack that retail and tech has in spades: marketing-ready customer data. Hospitals and health systems have mountains of clinical patient data. But when it comes to marketing, it sits largely unused — often due to struggles with HIPAA regulations, tech maturity, and disconnection between Marketing and IT teams.

Contrast that with retailers who’ve had sophisticated loyalty and CRM programs for a decade, using behavioral, purchase, identity, and attitudinal data to create a single view of the customer and build truly personalized customer shopping experiences (not just personalized ads). Ahem, Amazon.

Now carry that into healthcare. A retailer can analyze purchase history to identify customers who buy OTC allergy medication every spring and offer targeted promotions for allergy testing or Rx medication. Could that data be shared with a PCP or home health provider within the retail health network before a visit? Might customers need a nudge to schedule an appointment during allergy season? Or personalized content, complete with recommendations (and discounts) on natural allergy relief products?

Not only do you now have an engaged customer, but you’ve also got new revenue streams.

Here’s the rub . . . one of the biggest challenges when you port consumer data into the health space is consent management. The restrictions around using PHI for marketing purposes are muddy waters. You’ll need explicit consent for the PHI to be used for non-clinical purposes, and that consent must be given for each covered entity using it.

But even with these challenges, there are unlimited ways to take your existing consumer data and identify gaps in the healthcare marketplace, create new offerings, and build healthcare into existing loyalty and CRM programs.

We data geeks think that sounds better than happy hour!

3. Build health into the customer experience

The number one place consumers notice measurable change is during the customer experience, be it in stores, online, or both. Remember when Subway launched its Eat Fresh Refresh in 2021 and said it would be (slowly) revamping its menus and food? Here we are, two years later . . . and nothing has changed. No, we don’t consider sliced turkey a real change . . . but we’re open to a debate over cocktails.

The point is: Start with the experience. Then build outwards.

For example, shortly after CVS and Aetna merged, CVS launched its longstanding MinuteClinic services online, later following up with mental health services in stores, and ultimately shifted its entire homepage experience to focus solely on health (with only a small module for retail items).

So — back to that customer data mountain.

Let’s say that you’re Kroger, building out The Little Clinic’s services. Your highest-spending grocery customers are women ages 34-54 with multiple children in the household. What healthcare offerings do they lack? Could you bundle services for the whole family in one visit — with scheduling options built around their calendar, along with discounts for retail items that they can use at the same time?

Could your providers then give grocery recommendations as prescriptions, served up through personalized content: “5 fruits to boost your heart health — and a special discount on blueberries.”

Then, could you include signage around the store to highlight those healthy options, backed by The Little Clinic experts?

If done in the right way, these bundled services will make shoppers feel cared for and open cross-promotion opportunities.

4. Hiring for health

Last, but most important — to be seen as a true care provider, your employees must be truly caring. This can be especially challenging for retailers, who already face staffing issues and high turnover.

But consider the Chick-fil-A hiring model. The fast-food chain looks for candidates with a knack for customer service, a passion for the brand, and wholesome values.

Or REI — not only does REI hire folks with a passion for the outdoors, but their associates can also talk shop with any customer about any outdoor sport. Want to know which bug spray kept the mosquitoes away on an REI team member’s recent camping trip? Ask them. Curious about which shoes will be best for an upcoming hike up a 14-er in Colorado? Just ask. Better yet . . . ask which 14-er trail is the most technical, and which is best for a newbie hiker.

Before you say it — no, healthcare is not the same as selling chicken sandwiches or bicycles. It takes a thousand times more expertise, more experience, and more passion.

Which is why your hiring strategy matters . . . possibly more than anything else you do.

If you’re a retailer moving into healthcare, what would it look like to hire those with a demonstrated passion for health, and then train them on basic understanding of the top chronic conditions in America, at minimum?

Better yet, many RNs, CNAs, and other healthcare professionals are leaving the field in search of higher pay and lower stress — could you recruit folks with a true background in healthcare and provide a top-notch employee experience?

This is where you can win against other new entrants. So far, concierge medical services and primary care entrants have focused more on convenience than clinical expertise. Imagine offering both…

As Russ Meyer, Senior Director of Brand Strategy at CVS Health noted in Joe Public 2030 by BPD Chief Growth Officer Chris Bevolo: “It’s far easier to gain knowledge than it is to change culture.” Consumer-focused brands across retail, tech, and other verticals already have consumer-focused culture. But, to compete in healthcare, they need to “buy” medical knowledge. This means hiring a CMO. Hiring a healthcare workforce. And embedding healthcare and medical expertise at every layer of operations. Perhaps that sounds tough. But it’s far easier than the job legacy healthcare organizations must do — which is build a consumer-focused culture around existing clinical knowledge.

Shifting your hiring strategy is not an easy thing to do, but it may be the most important thing you can do. It will create a long-term, positive impact for both employee experience and customer satisfaction.

Conclusion

Even with the very long ABC-like list of companies expanding into healthcare, there’s still plenty of room for new entrants. As Clayton Christiansen noted 15 years ago in The Innovator’s Prescription, healthcare cannot continue to sustain high, inefficient costs — it’s ripe for disruption. We are witnessing that disruption before our very eyes, and there’s room for much, much more.

As you make your healthcare move, what “healthy signals” will you use?

Related Blog Posts

Stay in Touch

Stay in Touch

Receive our updates, industry news and insights.